There are a number of resources that help people overcome their financial crises or even manage their financial wealth. Each industry has its unique pattern according to which they work. When we talk specifically about the health industry, healthcare credit unions are the institutes that help healthcare professionals in their financial causes.

If you have a basic health account in any bank, a healthcare credit union might be a better option for you, no matter if you are working in any post in the industry.

But if you are confused should you go for it or not, we have the guide you need. Today you will know all about these unions along with all the answers you might be searching for.

What Facilities Do Healthcare Credit Unions Provide?

Credit unions offer many financial facilities for healthcare providers. These services may vary according to each institute, but in order to give you a thorough idea here are some top services provided by healthcare credit unions:

Saving Accounts

Healthcare credit unions offer a variety of savings accounts. These accounts include:

- Regular saving accounts

- High-yield account

- Money market account

By using these accounts you can save a lot of your expenses.

HCUs also take following initiatives for financial education and counseling services to help you get awareness:

| Service | Description | Frequency/Availability |

| Financial Workshops | Group sessions on budgeting, investing, and financial planning | Monthly |

| One-on-One Counseling | Personalized financial advice and planning sessions | By appointment |

| Online Resources | Access to financial tools, calculators, and educational articles | 24/7 |

| Seminars | Educational seminars on specific financial topics | Quarterly |

| Retirement Planning | Guidance on retirement savings plans, investment options, and withdrawal strategies | By appointment |

Checking Accounts

Healthcare professionals can access and check their accounts with this facility. They can review their daily transactions, including writing checks, making e-payments, and using debit cards for financial purposes.

Loans

Just like other banks, the healthcare credit union offers helpful loans in certain conditions. These loans include:

- Personal loans

- Auto loans

- Home loans

- Medical equipment loans

These loans are very helpful if you are stuck in a certain financial condition and they often come with competitive interests and flexible payment methods.

Credit Cards

Credit cards with rewards, cheaper interest rates, and exclusive deals for medical bills may be available from healthcare credit unions.

Your Journey to Becoming a Healthcare Professional Starts With a Single click—take Action Today.

Student Loan Refinancing

Refinancing alternatives for student loans are widely available from healthcare credit unions, which can aid healthcare workers in better managing their student loan debt.

Medical Equipment Financing

Some credit unions are experts at financing medical equipment acquisitions, assisting healthcare organizations to get the tools they need.

Financial Education And Counseling

In order to assist members in making wise financial decisions, healthcare credit unions frequently provide financial education tools, courses, and counseling.

Online And Mobile Banking

Through online banking services and mobile applications, members may easily manage their finances, execute transactions, and access their accounts.

Retirement Accounts

Healthcare credit unions may offer retirement savings options, such as Individual Retirement Accounts (IRAs) and other retirement planning services.

Healthcare Professionals’ Services

Healthcare workers may benefit from specialized services such as professional development loans, career counseling, and insurance policies designed specifically for them.

Business Banking Services

These unions may provide banking services to the healthcare industry, including business accounts, loans for small businesses, and cash management services.

Community Support

Through collaborations, grants, and sponsorships, several healthcare credit unions actively participate in and assist their local healthcare communities.

Why Is It A Good Option Than Random Banks?

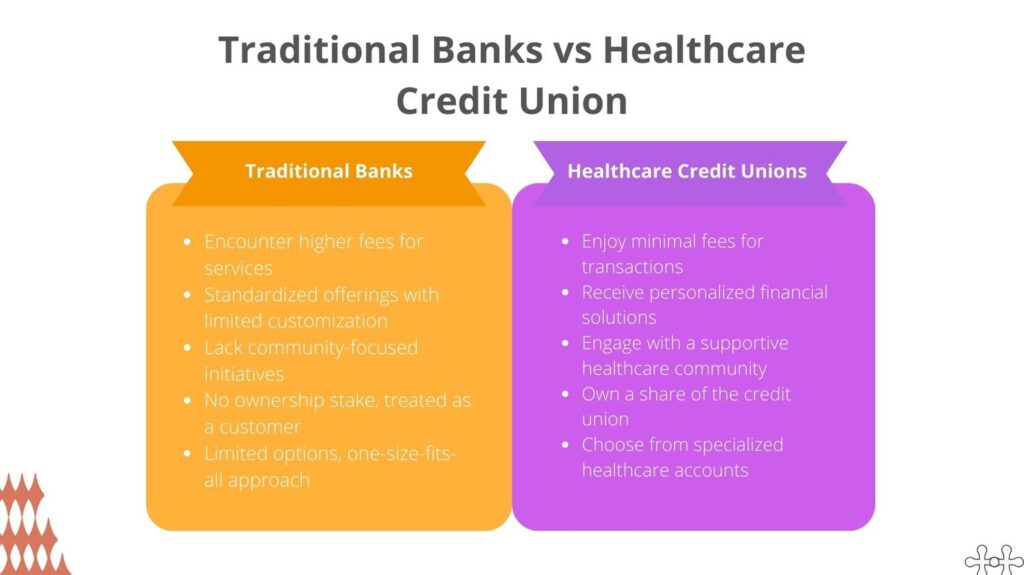

There are various benefits to choosing a healthcare credit union over a random or traditional bank, especially for people and businesses in the healthcare sector. The following are some benefits of opting for this option:

Tailored Healthcare Expertise

Think of healthcare credit unions as specialized banks for those working in the medical industry.

They resemble business partners that truly “get” what healthcare professionals like physicians, nurses, and other staff members go through.

They are aware of the demanding schedules, difficulties, and aspirations of healthcare professionals.

These credit unions give financial services that are ideal for you because they comprehend your globe. There isn’t a one-size-fits-all method.

They offer services that are appropriate for your position, your objectives, and your desired results.

For instance, since they are aware of how crucial medical equipment is to your job, they may give specific loans for it. Or they may provide savings strategies that are tailored to your particular financial circumstances.

Lower Fees And Better Rates

These credit unions are there for you whether you want to borrow money (like receiving a loan) or save money (like opening an account). Compared to the major banks, they offer better costs.

Therefore, you could eventually pay less interest if you need to borrow money. Additionally, if you save more, you may receive higher interest, which is similar to your money growing on its own.

Consider these credit unions as your money’s best friend since they will protect your wallet at all times and will encourage you to save more for the things that are important to you.

Personalized Service

Imagine entering a bank where you aren’t simply a client; rather, you are a member of a unique club, much like a large family. This is how healthcare credit unions operate.

They are your true banking friends who care about you, not just ordinary banks.

Are You a Healthcare Professional? Get Wonderful Discounts!

Consider yourself and the other members of the credit union as co-owners. Together, you’re deciding how things will go forward. They truly listen when you speak since they are like a close-knit family.

They seek to comprehend your needs and objectives. It’s similar to doing your banking with a friend who is always available.

Community And Collaboration

Have you ever heard of a bank that cares more about improving your town than just generating money? Healthcare credit unions are focused on achieving that. They serve your whole community, notably the healthcare industry you work in.

These credit unions serve as local heroes. They provide your workplace and the people you work with a great deal of consideration. They assist with community healthcare events and activities.

Think of them as your financial partners, helping you and your coworkers improve your neighborhood.

Being a member of a credit union involves more than simply banking. It’s about being a part of a group that cares, works together, and makes progress.

It’s like being a member of a club that cares about everyone in your healthcare industry, not just you.

Member Ownership And Values

The truly interesting thing is that these credit unions aren’t only concerned with maximizing profits. They are considerate of your demands.

They therefore consider your best interests and that of your fellow members while making decisions rather than simply their own financial gain.

Taking care of the full person, not just their medical needs is in line with what the majority of healthcare professionals think. It’s like having a money partner that supports your goals and shares your ideals.

Being a member of a healthcare credit union is about more than simply getting a good deal. It’s also about having a voice, being heard, and supporting an organization that puts people before profits.

How To Approach Any HCU?

Now that you know the importance of a healthcare credit union and some reasons backed up its importance, you should know the process to do a contract with them.

Here are the steps you can follow to move towards a secure financial future.

Research

To find any company or institute, research comes first. Spend time finding out the best healthcare CUs in your area. Make sure to approach a local institute as it will be easier for you to visit them regularly.

Another thing to keep in mind is to look for a reliable institute as it is a matter of money.

Check Eligibility

Each credit union has its membership requirements that only if you fulfill you can avail of their services. So ask the institute and make sure you are eligible for that credit union.

Visit Their Site

It is said that to know about any company or institute, just a website, is enough. Go to your preferred institute’s site and read about their services, years of providing services, their areas of services, and charges.

This will help you understand their specialty.

Pay A Visit

After finishing your reading and analyzing work, contact the healthcare credit union and ask about their services. For further understanding, do pay a visit and see the environment of the institute.

This visit will give you an idea if the company can be trusted or not.

Ask Questions

When paying a visit, make sure you clear all your doubts. Ask about any question/query you have and clearly understand their work approach.

For a basic inquiry idea, ask about their top financial products or services, healthcare discounts, rates, fees, and any other benefits they provide.

Compare Offerings

Now that you have an idea about multiple healthcare credit unions, compare everyone. See which one offers the most interest rates, low charges, best facilities, and helpful services.

Visit The Branch

Even after visiting their main institute, go to their branch as well. It will help you judge their customer service so if you have an emergency regarding anything, will they be able to help you or not?

Membership Application

Once you are satisfied with their services and charges, process the application form to become their permanent member. This requires providing personal and professional information.

You will also have to open an account with some deposit fee which will mark the completion of the process.

Top 10 Healthcare Credit Union Companies

You have pretty much knowledge about healthcare credit unions. What if we simplify your research work and provide you with a list of companies that you can trust for your bank-related chores?

Based on our research and top reviews, here are some HCU companies in all over the United States.

FirstHealth Credit Union

Located in Western North Carolina, FirstHealth Credit Union is a non-profit financial cooperative that offers services to its members.

It has more than 100,000 members and was established in 1954.

- There are no monthly fees for checking accounts.

- Savings account interest rates that are competitive

- For members, low-interest loans are offered

- Free smartphone app and online banking

- Members have access to materials for financial education

TruWest Credit Union

A non-profit banking cooperative, TruWest Credit Union provides services to its members throughout Texas and Arizona.

It has more than 200,000 members and was established in 1934.

- Members can open free checking accounts with direct deposits.

- Members get access to high-yield savings accounts and low-interest loans.

- Free smartphone app and online banking

- Members have access to materials for financial education

Partners Federal Credit Union

Cast, crew, Imagineers, retirees, workers, and their families are all served by Partners Federal Credit Union. It is a non-profit financial cooperative, at The Walt Disney Company.

It has more than 200,000 members and was established in 1957.

- There are no monthly fees for checking accounts.

- For members, low-interest loans are offered

- Free smartphone app and online banking

- Members of the Disney cast receive special discounts and advantages.

First Tech Federal Credit Union

A non-profit financial cooperative, First Tech Federal Credit Union provides financial services to family members and staff of the top technological businesses in the world.

With more than 800,000 members, it was created in 1952.

- For customers who receive direct deposits, checking accounts have no monthly maintenance costs.

- There are high-yield savings accounts.

- For members, low-interest loans are offered

- Members have access to financial training

- Discounts and advantages that are only available to workers of partner firms

Alliant Credit Union

Anyone who is a member of a qualified group, such as a former student or employee of a certain college or university, a member of a particular professional association, or an employee of a particular business, is welcome to join Alliant Credit Union.

Founded in 1935, it now has more than 600,000 members.

- There are no monthly fees for checking accounts.

- Members get access to high-yield savings accounts and low-interest loans.

- Members have access to materials for financial education

- With the Alliant Cash Back Visa Signature Credit Card, you may earn 3% cash back on petrol and restaurant purchases.

Want to be The Part of Healthcare Industry?

PenFed Credit Union

Anyone who is now serving or has previously served in the US military, as well as their families and colleagues, is welcome to join PenFed Credit Union, a non-profit financial cooperative.

It has more than 2.8 million members and was established in 1935.

- For customers who receive direct deposits, checking accounts have no monthly maintenance costs.

- There are high-yield savings accounts.

- For members, low-interest loans are offered

- When using the PenFed Pathfinder Rewards Visa Signature Credit Card to buy petrol, you might receive up to 5% cashback.

State Employees Credit Union

In North Carolina, state employees and their families can access financial services through the non-profit financial cooperative known as the State Employees Credit Union.

It has more than 2 million members and was created in 1936.

- Savings account interest rates that are competitive

- For members, low-interest loans are offered

- Members have access to materials for financial education

- Special savings and advantages are available to healthcare employees.

Navy Federal Credit Union

A financial cooperative that provides services to members of the US military, their families, and staff, Navy Federal Credit Union is a non-profit.

It has more than 12 million members and was created in 1933.

- There are no monthly fees for checking accounts.

- Members get access to high-yield savings accounts and low-interest loans.

- Members have access to materials for financial education

- Exclusive military discounts and advantages

USAA Federal Credit Union

An organization that provides financial services to members of the US military, their families, and their workers is known as the USAA Federal Credit Union.

It has more than 13 million members and was created in 1922.

- There are no monthly fees for checking accounts.

- Members get access to high-yield savings accounts and low-interest loans.

- Free smartphone app and online banking

- Members have access to materials for financial education

- Exclusive military discounts and advantages

Teachers Credit Union

In the United States, teachers and their families can access financial services through Teachers Credit Union, a non-profit credit cooperative.

It has more than 1.5 million members and was created in 1918.

- There are no monthly fees for checking accounts.

- Savings account interest rates that are competitive

- For members, low-interest loans are offered

- Free smartphone app and online banking

- Members have access to materials for financial education

- Teachers receive special discounts and advantages.

Your Path To Stability

In a world full of insecurities and uncertainty, making the right financial choices is crucial. You must take the right step today if you want to secure your future.

Have a look at this short yet helpful comparison of membership benefits of top healthcare credit unions:

| Credit Union | Membership Benefits | Unique Feature |

| FirstHealth Credit Union | Lower loan rates, free financial counseling, discounted insurance products | Healthcare-specific financial advice |

| TruWest Credit Union | Cash back on credit card purchases, low-interest loans, free checking accounts | Member reward programs |

| Partners Federal Credit Union | Financial planning services, discounted tickets to healthcare events, low mortgage rates | Exclusive healthcare event discounts |

| First Tech Federal Credit Union | High-yield savings accounts, investment services, low auto loan rates | Advanced digital banking solutions |

| Alliant Credit Union | No-fee checking accounts, student loan refinancing, mortgage assistance | High-yield checking accounts |

So follow our guide, find out about healthcare credit unions in your area now, and open your account. This will not only strengthen your financial stability but also help you out during the time of crisis.