On average, healthcare revenue cycle length in the US is about 42 days, this means it would take more than a month for you to collect your revenue. But don’t you think the process should be completed earlier? The faster the revenue collection, the more stable your healthcare facility. So here if your hospital too faces such a lengthy cycle let us tell you the 13 steps of revenue cycle management by following which you will optimize your revenue generation.

Everyone wants quick revenue. So you must know these steps in detail along with some best practices to complete the process with full accuracy. Read our guide till the end and have a roadmap to manage your cash flow.

The Very First Step – Patient Information

When we talk about the RCM process, we discuss normal patient cases like when someone comes to get a treatment or diagnosis.

Here emergency cases are excluded because in that case the process might differ and some steps might be skipped for the patient’s life safety.

So when the patient comes to the reception, the staff takes basic information from the patient. This involves:

- Patient’s full name

- Date of birth

- Gender

- Marital status

- Contact information (phone number, email address)

- Address (home address, mailing address)

- Reason for visit

Here the basic patient profile is made in order to make the process efficient by having some work done in advance.

To do:

- Collect all necessary patient information accurately and completely.

- Verify patient insurance eligibility early in the process.

- Obtain patient consent for treatment and billing procedures.

Step 2: Insurance Eligibility

Many times patients come at the dependence on insurance. But when they realize their insurance packages either don’t cover a specific treatment or can’t pay the bill, the patient has to make the payment after the treatment.

This results in huge problems for both hospitals and the patients themselves.

That’s why insurance eligibility verification is essential. After the patient’s information is recorded, staff contact their respective insurance companies.

They ask about the remaining insurance plan coverage by telling the services a patient may receive soon.

This process makes sure the patient is eligible and thus they are tension-free from paying huge medical bills.

To do:

- Make quick contact with insurance providers to confirm patient coverage.

- Verify the patient’s coverage limitations and benefits for the anticipated services.

- Keep a record of every detail related to insurance verification in the patient’s file.

Step 3: Patient Registration

Now is the time for proper patient information gathering. This process involves the collection of a patient’s medical history, financial background, and other bill-related details. In this step, consent forms are also signed.

This process ensures accurate billing, reducing errors and eliminating time-consuming tasks. After all these details have been taken, the patient is registered officially in the systems of the healthcare facility.

Many times there are repeat patients in the hospital. So this record keeping saves from collecting information in the future. Instead, they ask for some crucial information only and begin the treatment immediately.

To do:

- Get all of the patient’s financial, insurance, and demographic data.

- Check that all patient data is accurate.

- Get the patients’ signatures on all required documents.

Step 4: Treatment Begins

After registering the patient, they are given the proper treatments they have come for. Since it all has to be mentioned in the bill, the entire procedure is being recorded by a medical biller.

Not only medical services but also equipment used during the treatment is recorded.

To do:

- Make sure you accurately record every service you give the patient.

- Keep track of how all medical supplies and equipment are used.

- Get the consent of the patient for any extra services or supplies.

Step 5: Charge Capture

This process is the continuation of the previous one. Here the treatments are properly documented by the staff. But this step holds great importance among all the 13 steps of revenue cycle management.

Based on this document you will create a bill and receive the payment, so it is crucial to maintain accurate records of the procedures.

Any deviation from the actual service or equipment used can cause your claim application to be rejected. So make sure you keep all the information exact.

To do:

- Timely documentation of all fees for supplies and services is required.

- Verify that all charges are correct and adhere to insurance regulations.

- Make use of an integrated charge capture system with the billing system.

Step 6: Medical Coding

After you have the document listing all the services given to the patient, the medical coder comes into play. They analyze the document and allocate codes to create another document: Claim (which we will discuss soon).

Medical coding is a complex process. Consider medical codes as a secret code assigned to each medical treatment and equipment. Only a coder has the skill to write accurate codes for the medical procedure in the claim application.

These codes help insurance companies decode the claim application. This way they know what services a patient received and what they have to pay.

To do:

- Give each service and supply a valid medical code.

- Make use of the most recent coding standards and conventions.

- Make sure staff members receive regular coding training and certification.

Step 7: Claim Submission

What are claim applications? If you don’t know, let us tell you that a claim application is a document containing codes instead of a medical procedure and supplies used on a patient.

After it is completed it is sent to the insurance companies.

This is another crucial step because insurance companies ask for a perfect and 100% complete application. Any inaccuracy may lead to claim denial and thus loss in revenue.

To do:

- When feasible, send insurance companies your claims electronically.

- Make sure the claims are timely, accurate, and comprehensive.

- Verify the status of claims to guarantee timely payment.

Step 8: Rejected Or Accepted?

Here the process might take 2 turns. Either your claim will be accepted or rejected.

When it is rejected, most of the time, insurance payers identify the error which you are required to solve ASAP. But we advise you to take precautionary measures early on to not go into this phase.

The reason why we are saying this is that it becomes more difficult for healthcare facilities to recover from this phase. When their claims are denied, they are less likely to regain this amount. So try to protect your claims from this phase.

And if your claim is accepted, well and good. You will receive your payment and thus the most difficult process has been successful.

To do:

- Examine rejected claims closely in order to find and fix any mistakes.

- Quickly resubmit any rejected claims.

- Appeals dismissed claims when required.

Other crucial dos and don’ts of RCM are:

| Do’s | Don’ts |

| Verify patient insurance eligibility | Don’t neglect training staff on RCM processes |

| Educate patients on their financial responsibility | Don’t ignore denied claims, investigate and appeal promptly |

| Use technology for accurate coding and claims submission | Don’t rely solely on manual processes for billing and coding |

| Regularly review and update fee schedules | Don’t delay in following up on outstanding balances |

| Implement clear and transparent billing practices | Don’t ignore patient complaints or feedback about billing |

| Conduct regular audits to identify billing errors | Don’t overlook updating patient information regularly |

| Provide staff training on compliance regulations | Don’t overlook updating fee schedules or payer contracts |

| Utilize data analytics to identify trends and opportunities for improvement | Don’t submit incomplete or inaccurate claims |

| Establish clear communication channels with payers and patients | Don’t disregard patient financial assistance options |

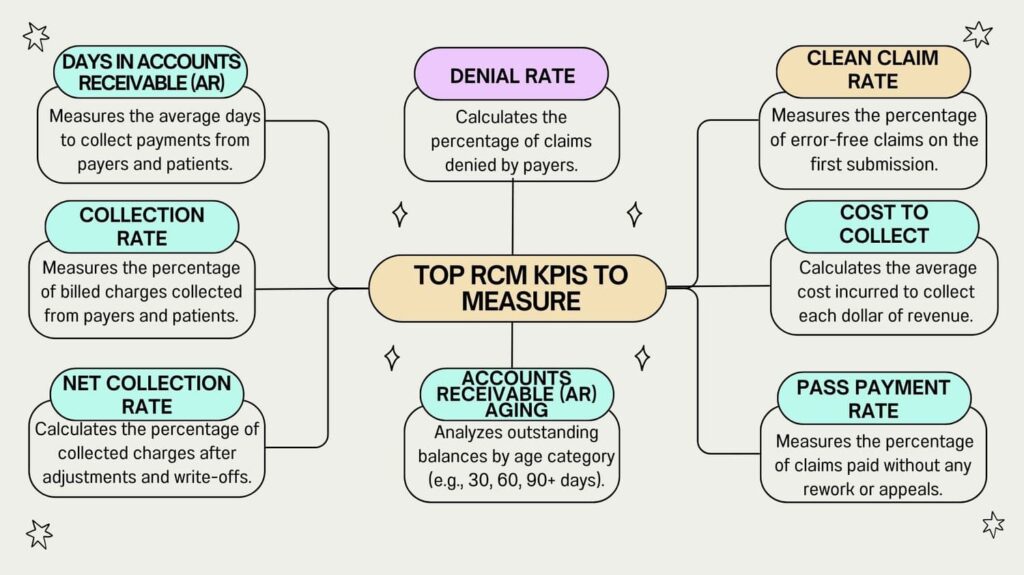

| Monitor and track key performance indicators (KPIs) | Don’t delay in resolving claim denials or appeals |

Step 9: Bill Creation

Now the work of insurance companies is done. Here a medical biller will create the bill and send it to the patients.

Many of you might think what is the use of sending bills to the patient when their insurance plan has covered their expenses?

Despite having your insurance cover most of the medical bills, patients owe some amounts known as copayments and deductibles.

So when the bill is sent, they have to make the payment within a specific deadline.

To do:

- Make patient bills that are correct and in compliance.

- Provide all relevant information on the bill, including charges, insurance information, and patient demographics.

- Patients should receive bills right away.

Step 10: Receive The Bill

After sending the bill, obviously, the next step is that the patients will pay the bill. This is the step every healthcare facility wants to be completed soon. But following these 13 steps of revenue cycle management can just help you do that.

This step marks the completion of the cycle and an increase in financial wealth.

To do:

- Monitor delinquent invoices to guarantee prompt settlement.

- Provide patients who are unable to pay in full with payment plans or discounts.

- If necessary, forward past-due accounts to a collection agency.

Step 11: Follow-Up

When a patient doesn’t provide a positive response to the bill, you have to send reminders to maintain follow-ups. But, many times patients can pay the bill at once. So what is the process after that?

When such a condition arises, hospital staff is required to have a detailed conversation with them. Learn about their financial conditions and issues.

By analyzing the situation, you then have to offer patients some payment plans either discounts or installments to reduce their burden. It helps them make the payment without disturbing their budget.

To do:

- Keep in constant contact with patients regarding their bills.

- Help patients who are having trouble paying their bills.

- Quickly settle billing disputes.

Step 12: Medical Collection

When even after offering patients some favorable payment plan, they don’t respond, healthcare facilities hire medical collection agencies.

The role this agency plays is that they pay the hospital amount by themselves. After that, they contact the patient, communicate with them, and find a middle way to get the payment in installments.

But medical collection is a nightmare for patients. Since your bills are then declared as debt and this impacts your credit score.

To do:

- Employ a trustworthy medical collection company.

- Keep an eye on the collection agency’s performance.

- Talk to patients about the collection efforts.

Step 13: Reporting

These were all the 13 steps of revenue cycle management. Though you have received your revenue on time, it is essential to perform proper evaluation and reporting in order to avoid future errors.

This analysis will help you find out your weaknesses so you can work on them and optimize your revenue further.

To do:

- Keep an eye on important revenue cycle metrics like net collection rate and days in revenue cycle.

- Determine which aspects of the revenue cycle process need to be improved.

- To maximize the performance of the revenue cycle, make data-driven decisions.

Successful RCM

For a healthcare facility, it is crucial to install a proper RCM system at the hospital. So utilize all the 13 steps of revenue cycle management and have a process running in a circle.

Also, keep in mind these metrics and measure them regularly to know your progress:

| Metric | Description | Target/Goal |

| Days in Accounts Receivable (DAR) | Average number of days to collect revenue after service provided | Less than 30 days |

| Clean Claims Rate | Percentage of claims accepted without rejections | More than 95% |

| First Pass Rate | Percentage of claims accepted on first submission | More than 90% |

| Denial Rate | Percentage of claims rejected or denied by payers | Less than 5% |

| Collection Rate | Percentage of outstanding balances collected within a specific timeframe | More than 90% |

| Aging of Accounts Receivable | Breakdown of outstanding balances by age categories (e.g., 0-30 days, 31-60 days, 61-90 days, >90 days) | Majority within 0-30 days |

| Claim Rejection Rate | Percentage of claims rejected by payers due to errors or missing information | Less than 3% |

| Time to Payment | Average number of days from claim submission to payment receipt | Less than 45 days |

| Patient Satisfaction Score | Rating or feedback provided by patients regarding their billing experience | 4 out of 5 or higher |

| Staff Productivity | Number of claims processed or accounts worked per staff member per day or per hour | Target varies based on workload |

| Cost to Collect | Total cost incurred to collect revenue, including staffing, software, and other overhead costs | Less than 10% of revenue collected |

| Claim Denial Resolution Time | Average time taken to resolve denied claims from identification to resubmission or appeal | Less than 30 days |

| Average Reimbursement Rate | Average amount reimbursed per claim or per service rendered | Target varies based on payer rates |

This way you will focus on other areas of the facility while generating ample revenue.